Sri Lanka’s leading private bank, HNB PLC, joined several internationally-renowned financial industry peers, in contributing to discourse on issues of key interest to the global banking industry, at the recent Policy Advocacy Committee Meeting of the Asian Bankers Association (ABA).

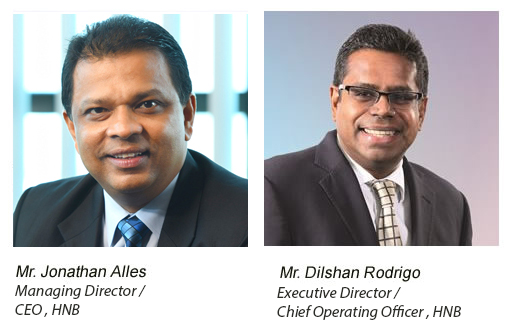

HNB’s Managing Director / CEO, Jonathan Alles, in his capacity as the current Chairman of the Asian Bankers Association, inaugurated the event while HNB’s Executive Director and Chief Operating Officer, Dilshan Rodrigo, who also serves as the Chairman of the ABA’s Policy Advocacy Committee, served as the Session Chairman.

“Greater collaboration and knowledge sharing within the banking industry is critical in navigating the emerging risks and challenges of the new normal,” HNB Executive Director and Chief Operating Officer, Dilshan Rodrigo said, commenting on HNB’s presence at the ABA Advocacy Committee Meeting. “Given this pressing need, HNB takes pride in contributing to much-needed discourse on such topics, as well as in representing South Asia’s commercial banking sector at this crucial gathering of industry leaders.”

HNB’s presentation to the distinguished forum, which included senior banking sector leaders from both Asia and other regions, was delivered by its Chief Information Security Officer, Suresh Emmanuel.

In his presentation, Emmanuel highlighted the need for a holistic approach to cybersecurity that goes beyond mere technology, as well as the need to employ a long-term view in evaluating the return on investment (RoI) of cybersecurity investments.

“An organization’s cybersecurity governance framework has to complement its business goals,” Emmanuel noted. “Creating awareness and initiating the cultural change required are key components of this framework. It is important to recognize that cybersecurity is about more than purely technology and needs to take into consideration people and process-related factors. In implementing changes in technology, the people factor is critical, since organizations can face resistance from within the ecosystem, as people would be used to the way that things have been done for many years.”

“In terms of ROI on cybersecurity investments, it is important to fully leverage a system in order to enjoy its full benefits. Organizations need to take a long-term view in evaluating ROI of such investments,” he added.

The other presenters at the event included the MD of Erste Group Bank AG headquartered in Austria, senior officials of Rizal Commercial Banking Corporation – a reputed Commercial Bank in the Philippines, a Member of the Board of one of Iran’s major banks – Bank Pasargad, the CEO of the global non-profit – European Financial Management Association (EFMA) and the MD of India’s financial sector advisory provider – Fintelekt Advisory Services. These presenters covered key issues of concern to the global banking industry ranging from the role of banks in supporting business survival following the pandemic to addressing heightened challenges with regard to Anti-Money Laundering (AML) / Combating the Financing of Terrorism (CFT) in the ‘new normal’.

Recently, HNB’s Managing Director and CEO, Jonathan Alles, was a member of the panel of the ‘CEO roundtable’ at ABA’s 37th General Meeting and Conference while the Bank’s Executive Director and COO, Dilshan Rodrigo was the Session Chairman of the ‘regulator roundtable’ of the same event.

Since 1981, the Asian Bankers Association (ABA) has been the premier platform for Asian banks. ABA is the ideal forum to network, conceive deals, share know-how, and advocate bankers' interest nationally and internationally. ABA groups over 70 of the largest leading commercial banks and financial institutions in the Asia Pacific with the objectives of exploring banking opportunities in the region and enhancing the role of bankers in the economic development of the Asia Pacific.

With 254 customer centres across the country, HNB is one of Sri Lanka’s largest, most technologically innovative banks, having won local and global recognition for its efforts to drive forward a new paradigm in digital banking. HNB has a national rating of AA- (lka) by Fitch Ratings (Lanka) Ltd. The bank was also ranked among the World Top 1,000 Banks list compiled by the prestigious UK-based Banker Magazine for five consecutive years. HNB was also declared Best Sub-Custodian Bank in Sri Lanka at the Global Finance Awards 2020.